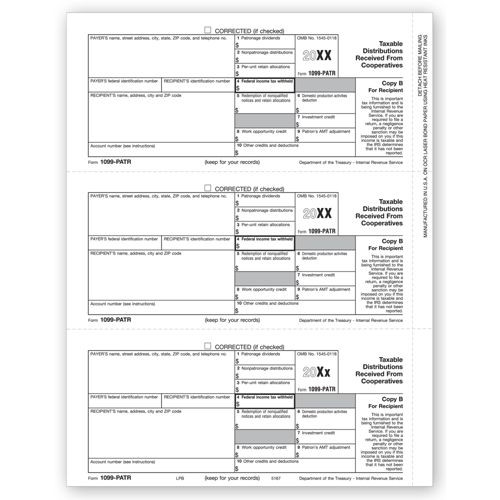

Description

Meets all government and IRS filing requirements. Popular format is ideal for reporting taxable distributions received from cooperatives. Printer Compatibility: Compatible with laser or inkjet printers. Paper Filing Due Date: To IRS, February 28th // To Recipient January 31st. Quality Paper: Government approved 20# bond paper. Use to Report: Distributions from cooperatives passed through to their patrons including any domestic production activities deduction and certain pass-through credits. Tax forms per sheet: Three filings per sheet. Amounts to Report: $10 or more.

SIZE: 8 1/2 x 11"