Description

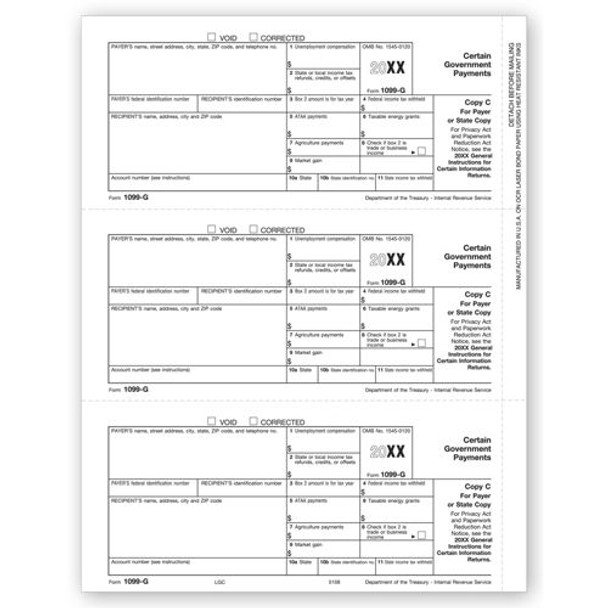

Meets all government and IRS filing requirements. Popular format is ideal for reporting certain government payments. Paper Filing Due Date: To IRS, February 28th // To Recipient January 31st. Amounts to Report: $10 or more for refunds and unemployment. Use to Report: Unemployment compensation, state and local income tax refunds, agricultural payments and taxable grants. Tax forms per sheet: Three filings per sheet. Printer Compatibility: Compatible with laser or inkjet printers. Quality Paper: Government approved 20# bond paper.

SIZE: 8 1/2 x 11"